Why must you well-apprehend your O2C needs?

Your organisation must understand O2C requirements at a granular scope since it directly impacts multiple corporate management processes, such as inventory management, supply chain management, finance management, customer relationship management and more. Hence, O2C can be defined as the apex of many other vital business efforts that your company makes. To summate, your business operations’ success mimics the level of how comprehensive and successful you are in meeting O2C requirements. O2C operation allows you to be well-versed on how efficiently you utilise your working capital and cash inflows.

If your ERP system does not house capable O2C services, your company has a very considerate drawback. Before we learn how technology can boost your O2C endeavours, let us understand O2C as an indispensable process for your company.

Learning about O2C as a process

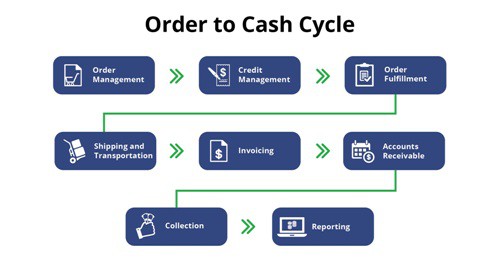

As mentioned above, the O2C process encompasses all processes between receiving and meeting customer demands and collecting cash from the customer successfully. There are a few steps that you should familiarise yourself with to understand the O2C procedure as a process. The steps are briefly mentioned below.

- The O2C process initiates when the order meets the company. There are several ways a customer can place an order. It can be through a social media platform, a call, an email, or any other Electronic Data Interchange method or traditionally, the customer will request in person.

- Some companies will conduct research- a credit review- to assess the client’s feasibility to meet the financial terms.

- After documenting the purchase order, the company begins to fulfil the order requirements.

- The product will then be sent via logistics services, or the service will be delivered to the client soon after; an invoice will be issued after order fulfilment and customer demand meeting.

- After the customer makes the payment, the financial books of the company will be updated with the transactional data.

Common Misinterpretations and Ambiguity related to O2C processes

Technological optimising O2C processes

With integrated automation, many competent software vendors enabled O2C services via fully-fledged ERP systems. Simulation technology can be harnessed by such solutions to display precise visualisation dashboards for finance and operational managers to view standards and current performances of O2C actions under one ubiquitous platform. An O2C module would normally house the following features to streamline your companies order taking and order delivering and completing processes.

- Real-time Order Management protocols to meet every demand on time

- Credit Management Features

- Order fulfilment and shipping management tools

- Automated invoice generators

- User-friendly payment portals

- Comprehensive finance management tools and more