Contents

- Understanding CPF for rookies

- The four types of CPF accounts

- Some Facts about CPF you should not miss

- CPF Eligibility Criteria

- Employees’ and Employers’ Contribution Ratios of CPF

- CPF Wage Ceilings for Employees for Ordinary and Additional Wages

- Calculating CPF Contributions for fresh PRs

- Current Interest Rates of CPF accounts

- CPF Allocation amongst CPF Accounts

- Retirement Schemes after your 55th birthday

- Benevolent CPF donations for social wellbeing

- Fees levied from Employers on top of their CPF Contributions

- CPF Contribution submission by Employers

- All you need to know about Direct Debit

- Amendment or deletion of submitted CPF contributions

- Proactive Contact Services to inquire about CPF complications

- Summary

Understanding CPF for Rookies

- Enough funds for spending on restorative care,

- Housing- or ownership of homes,

- Protection of Family,

- Asset Enhancement,

- Vital Retirement Provisions, and more.

The Four Types of Accounts Controlled by The CPF System?

OA (Ordinary Account)

OA is the account that provides for investments, housing, higher education and insurance. Anything that is left of your OA will be transferred to your RA to be used during your retirement after your 55th birthday (interest rates of this account can currently cap up to 3.5% per annum). The OA account comes most in handy when you are young! Its balance is multifaceted, for it can be used for several mandatory financial requirements that any person would come across before they reach middle age. There are a few key facts that you must familiarise yourself with when understanding the legal compliances and rules of being a legitimate OA holder.

Housing Fact: This CPF account is purportedly used by most Singaporeans to accrue funds for housing requirements. Under certain rules and regulations, it allows the account holder to buy private properties and HDB (The Housing and Developmental Board- a statutory board under the wing of the Ministry of National Development in Singapore) public housing (public flats). If a private property bought by using OA balances will be sold then the account holder will be obligated to pay the amount back into the CPF account, but if it is an HDB flat, this regulation does not comply. There are certain withdrawal caps and mandatory cash portions when passing money for housing properties. If you are looking to defray the costs of your property, you can even seek the assistance of the HDB grants to receive CPF housing grants.

Education Fact: The account holder has the efficacy of using OA savings to fund for their own, spouse’s, relatives’ or children’s subsidised educational expenses for a course comprising an array of pre-approved programs. It is also a fact that the benefitted party (the student in this case) is liable to remit the money paid by the OA holder one year after his or her graduation unless it is waived off by the account holder under qualifying conditions.

Insurance Fact: You can use your OA balances to settle the premiums for your Dependent Protection Scheme (DPS)- a type of insurance that financially facilitates the insured members and their dependents to get by the initial few years after the expiration, or to succumb to Total Permanent Disability or Terminal Illness of an insured member.

Investment Fact: You also can use the CPF ordinary savings balance to invest in a variety of CPF-approved financial products. But this must happen at your own risk since the CPF board does not take any responsibility if you lose money on OA investments- which is a certain risk that you must take with professional guidance.

SA (Special Account)

The account that provides financial products related to retirement and old age; note that the balance of this account can be invested up to a certain degree (interest rates of this account can currently cap up to 5% per annum). Compared to OA, the financial assistance of the SA is limited. It mostly concerns the retirement needs of the CPF members. The savings of the SA (also OA savings)can be most notable used for the following financial investment via the CPF Investment Scheme (it is arguable that these methods can beat the interest rates of CPF):

- Investment financial products

- Unit trusts

- Singapore Government bonds

- Investment-linked policies

- ETFs

- Treasury bills

The CPF account holder can transfer OA savings to the SA but once transferred they can be re-transferred back to the OA.

MA (MediSave Account)

The account that provides for medical insurances hospitalisation costs and settles other approved healthcare expenses such as medical procedure bills, surgeries, hospitalisation bills and so on. The Integrated Shield Plans -private health insurance plans- can amplify the MediShield Life (which is the nationalised health insurance scheme for Singaporeans) to cover medical expenses. This account can cover the premium payments partially too. (interest rates of this account currently cap up to 5% per annum). You can use this MediSave Contribution Calculator to check your MA contribution amount anytime.

RA (Retirement Account)

Some Facts About CPF You Should Not Miss

- The official CPG Government site states that statistically, Singaporeans live longer; 1 of 2 Singaporeans is expected to live for beyond 85 years and 1 of 3 are anticipated to live beyond 90 years of age. Therefore, it is highly recommended that you have fully-fledged CPF plans to spend your retirement days happily.

- The three key points that you must not forget when concerning CPF savings are:

- You must have the personal responsibility of staying employed to save a better sum of money through CPF savings

- The amount that you save will be owned by you; the government will only encourage your self-reliance through this system

- You have to perceive this as a lifelong income for the contributions will be redirected to you as a stream of lifelong retirement instalments

- The CPF LIFE Scheme would account for a monthly provision to suffice your basic expenses during old age and if you are qualified for CPF LIFE, you will be received with a monthly payout until you pass on.

- You have the efficacy of investing in properties because you can route for financial settlements that you can pay up fully when you retire.

- You can supplement your CPF savings with your own personal savings

- Spend your MediSave savings cost-efficiently since your healthcare expenses will grow with your age.

- Your validated MediSave savings can be invested to be used for premiums for health insurance plans like MediShield Life to settle unprecedented hospital and outpatient treatment costs.

- The CPF savings process allows members to withdraw money through schemes, namely ‘Lease Buyback scheme’ or ‘Silver Housing Bonus’, in case of emergency.

- CPF statistics as of the month of September in 2020

- Number of CPF members – 4 million people

- Number of CPF employees – 152, 909 employees

- Total CPF balance – S$ 453 billion

- Total OA and SA balances – S$ 22.7 billion

- Total CPF contributions – S$ 9.8 billion

- Total interest credited – S$ 15.6 billion

- Total Retirement Withdrawals and Payouts – S$ 1.5 billion

- Total Housing Withdrawals – S$ 2.2 billion

- Total Healthcare Withdrawals – S$ 1.1 billion

- Total Withdrawals under other schemes – S$ 528.9 million

Are You Eligible for CPF?

- A permanent employee,

- As a part-time employee,

- A contractual employee,

- Or a casual employee.

- Employees

- Company Directors

- Temporary Employees (Casual Employees)

- Family Workers

- Part-time employees

- National Servicing Men ( in-camp training)

| Factor | Minimum Requirement |

|---|---|

| Age | 18 Years Old |

| Legal Status | Not Undischarged Bankrupt |

| CPY (OA) Balance | S$ 20,000 (for CPFIS-OA) |

| CPF (SA) Balance | S$ 40,000 (for CPFIS-SA) |

Which brings us to another dire complication; if all employees are eligible for CPFIS, who is not eligible for it? Given below are the individuals that would not qualify for the prerequisites for being eligible to fit under the CPF scheme.

- Non-Singaporeans (along with S pass holders) working in Singapore

- Singaporeans and PRs in Singapore who works overseas

- Registered students who work during holidays from certain schools and Madrasah

- Registered students who are working for approved training purposes; this may be students from private institutions, polytechnics, students from international; institutions, institutes of Technical Education and more.

Here are two special considerations regarding CPFIS eligibility criteria are:

- If you are self-employed and earn a Net Trade Income of over S$ 6000 you are accountable for mandatory MediSave contributions, if not you are not.

- You are eligible for voluntary CPF contributions other than what will be accumulated by you and your employee under legally-bound regulations. Based on the allocation rates illustrated by the CPF website (explained further in the article) you can credit and distribute voluntary contributions into your CPF accounts- Ordinary Account, Special Account, and MediSave Account.

Let Us Familiarise With The Contribution Ratios of CPF

- The fact that you are a local citizen

- Or your SPR (Permanent Resident) status

- The age group you fall under

- Total wage per month (ordinary wages + additional wages)

Employee’s Contribution: This contribution is the amount that is withheld by the employer and transferred to your CPF accounts by your employer. The employee’s contribution is usually rounded down to the nearest lower dollar (i.e. if it is S$ 5.7 it would be waived off to S$ 5)

Employer’s Contribution: This contribution refers to the amount that the employer must contribute at his own expense to your CPF accounts (on top of the levies that he might be entitled to pay). This amount must not be inclusive of your stipulated salary. If the employer denies paying up, you can lodge a complaint in the Central Provident Fund Board. The employer’s contribution is usually calculated by deducting the employee’s share from the Total Contribution.

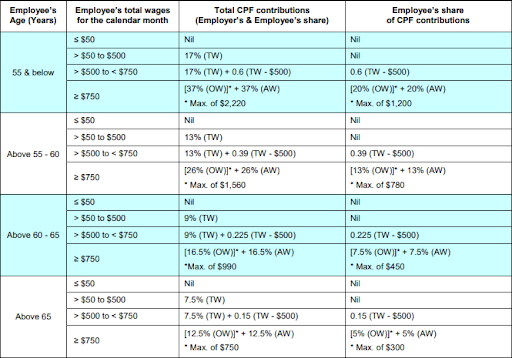

The employee’s and employer’s contributions will fluctuate based on your monthly salary and your age; the table below will explain how these contributions differ in different scenarios.

| Employee’s Age (Years) | Employee’s CPF (by % of employee’s wage) | Employer’s CPF (by % of employee’s wage) | Total CPF Rate |

|---|---|---|---|

| 18 – 55 | 55 – 60 | 60 – 65 | 65 and above |

| 20% | 13% | 7.5% | 5% |

| 17% | 13% | 9% | 7.5% |

| 37% | 26% | 16.5% | 12.5% |

But what if you are self-employed? If you are self-employed, the above contributions do not concern you; you can voluntarily accumulate your CPF savings except for MediSave contributions which you will be obliged to pay when filing your taxes every year.

Hypothetically if you are a pensionable employee and you earn S$5000 every month, and you are 25 years old, you will only receive 80% of your salary; the employer will withhold 20% of your wage, which will amount to S$ 1000 (20% of S$ 5000). This amount will be the ‘employee’s CPF contribution’. Your employer, on the other hand, will have to contribute 17% of your wage, which is S$ 850 (17% of S$ 5000) as the ‘employer’s CPF contribution’. This means your CPF accounts will be transferred with a total of S$ 1850 every month by your employer.

Did You Know There is A CPF Wage Ceiling for Employees?

Before learning about the government’s contribution to your CPF accounts and how the monthly CPF balances are allocated in your CPF accounts, let us learn about the CPF Wage Ceiling. The Wage Ceiling is a sort of a cap that indicates a certain limit that you can contribute to your CPF contribution on a monthly basis as an employee. There are two types of wages that you must be aware of before discussing CPF Wage Ceiling; they are:

Ordinary Wages (OW)

Ordinary Wages refer to wages that are payable by the employer to the employee wholly and exclusively for the employee’s employment before the due date of transferring CPF contributions for a particular month. Ordinary wages address the basic monthly wage of an employee and other fixed allowances that the employee would be given by the employer.

Additional Wages (AW)

Additional Wages refers to wages that are payable by the employer to the employee that is not wholly and exclusively paid for the employee’s monthly employment. These wages can be occasionally paid, like annual bonuses, commissions, leave pays or any other additional wages other than ordinary wages.

So how does the CPF Wage Ceiling cap these two wages? The Ordinary Wage Ceiling would cap your monthly CPF contribution to S$6000. The cap of the Additional Wage Ceiling is calculated using the formula is given below:

S$ 102,000 – (The Ordinary Wages subjected to the Annual CPF)

Example:

Let us look at an example to understand the two wage ceilings better and more vividly. If Jamie is an employee who earns a monthly salary of S$ 9000 and also is granted a bonus of S$ 15,000 for a certain year, how will Jamie contribute to her CPF accounts? Jamie will have to pay the ordinary wage ceiling of S$ 6000 as her CPF contributions, while the remaining S$ 3000 will be released by CPF. To calculate Jamie’s additional wage ceiling, the above formula must be used.

S$ 102,000 – (S$ 6000 X 12) = Additional Wage Ceiling

S$ 102,000 – S$ 72,000 = S$ 30, 000 (Jamie’s Additional Wage Ceiling)

Since Jamie’s additional wages (S$ 15,000) is lower than her additional wage ceiling (S$ 30,000) therefore, she will have to submit her entire annual bonus to her CPF contributions.

Calculating CPF Contributions for Fresh PRs

The CPF contribution ratio also differs based on not only age but also the status of employment. We are now gearing up to understand how a Singapore citizen, or PR (who obtained the status of residency three or two years earlier) would account for CPF contributions. The acronyms used in the table are unabbreviated below for better understanding:

OW – Ordinary Wages

AW – Additional Wages

TW – Total wages (the sum of OW and AW)

The table below illustrates the contribution rates of citizens and PRs (3rd year onwards) in Singapore.

As per the eligibility criteria, the foreign employees are not entitled to accumulate CPF receivable for later life, but if the employee obtains a PR then the employer will be responsible to accrue CPF submissions on behalf of the employee. During the first two years of obtaining the residency status, the contribution ratios are usually very low; the ratios that are affecting new PR applicants (applied since less than two years) are:

Full Employer & Graduated Employee (F/G)

Click the labels below to view the F/G contribution rates (from January 1st of 2016) table displayed according to the age groups for the first and second years since registering as an SPRs.

First Year

Second Year

Graduated Employer & Employee (G/G)

Click the labels below to view the G/G contribution rates (from January 1st of 2016) table displayed according to the age groups for the first and second years since registering as an SPRs.

First Year

Second Year

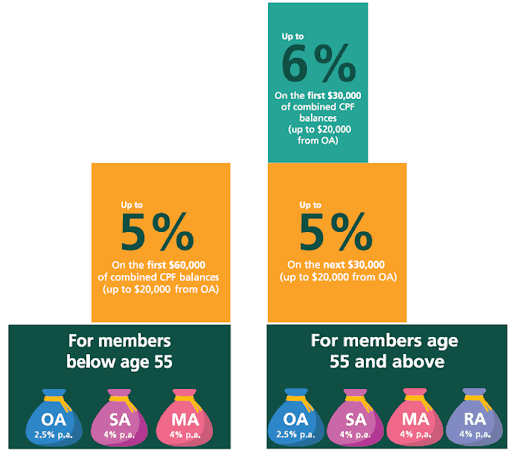

Current Interest Rates of CPF Accounts

| Age of Recipient | Extra interest rates paid by the government on Ordinary Accounts capped at S$ 20,000 |

|---|---|

| 18 to 55 years of age | 1% p.a on the first S$ 60,000 |

| 55 years old or older | 2% p.a on the first S$ 30,000 and then 1% p.a on the second S$ 30,000 (this allows you to earn up to 6% of your retirement savings) |

Explained below are the current CPF interest allocations in Singapore based on the type of accounts.

For Ordinary Accounts

Minimum Interest of 2.5 % per annum (reviewed quarterly). This rate is calculated based on the average of local banks’ interests of the given 3 months.

For Special and MediSave Accounts

Minimum Interest of 4 % per annum (reviewed quarterly). This rate is calculated based on the 12-month average yield of 10Y SGS (10-year Singapore Government Securities), summing up with an addition of 1%.

For Retirement Accounts

Also, accounts for a minimum Interest of 4 % per annum (reviewed annually). This rate is calculated based on the weighted average rates of interest of the cumulated invested portfolio. Fresh savings will be credited to the RA annually, where you can earn the 12-month average yield of 10YSGS (10-year Singapore Government Securities), summing up with an addition of 1%.

As mentioned above, generally, your OA account’s interest rate is lower than your SA; you can transfer some of your balance of your OA to your SA to get better interest rates. But you have to remember that each of these accounts has specific purposes, and once your money is transferred to your SA, you can’t transfer it back to your OA; which means you cannot use the balance in your SA for investments, higher education, housing and insurance- it is for the sole purpose of your retirement.

Don't Get Your Hopes High on Better Interest Rates!

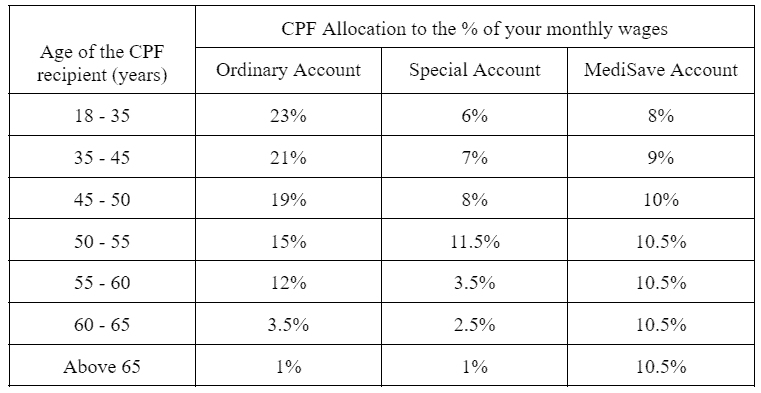

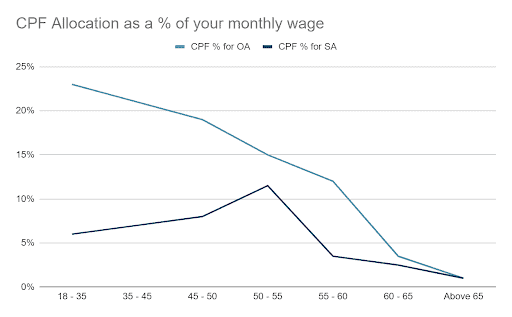

CPF Allocation- Distributing CPF Contribution Amongst CPF Accounts

As you know that your CPF accounts will be accumulating with time due to several causes of transfer, such as employee’s contributions, employer’s contributions, and the interest adding up your accounts will be intensifying its balances gradually. We already discussed how your interest rates are going to influence the summing up in your CPF accounts, but how will the contributions be ratio amongst your CPF accounts? In this section, we will be discussing how your CPF accounts partake a ratio of your CPF contributions based on two main factors:

- Employee’s Age

- Employee’s Type

CPF Allocation is a term used by the CPF board or CPF members to refer to how the CPF contribution will be distributed among the 4 CPF accounts. It is vital to note that CPF allocation will only be initiated if your monthly salary is S$ 750 or above. As the Retirement Account will be formed when you pass your 55th birthday, CPF allocation must be explained under several age boundaries. Let’s look at how a working Singaporean’s CPF allocation fluctuates when he or she gets older.

Weight of Priority given to CPF accounts when ageing

| 18 years – 45 years | 45 years- 60 years | 65 years and above | |

|---|---|---|---|

| OA (Striving to build a life) | 💗💗💗 | 💗💗 | 💗 |

| SA (Preparing for future retirement) | 💗💗 | 💗💗 | 💗 |

| MA (Having proactive finances for medical care) | 💗 | 💗 | 💗💗💗 |

What Happens Once You Celebrate Your 55th Birthday?

As mentioned before, the monies in the SA and OA savings of CPF members will be merged at the age of 55. The cumulative sum of retirement savings will be contingent on the amount of effort and spending that you have contributed to saving for your retirement. You will be able to retrieve a sound amount when you are 55 years old while retaining a portion to accumulate a retirement income; this portion is labelled as ‘The Retirement Sum’. At the age of 65, you will be entitled to receive the retirement sum in the form of payouts. There are retirement calculators integrated into the CPF Board site to help you determine your retirement goals and plans. Also, click here to view an infographic about how you must be ready to collect payouts if you are closing to your 65th birthday.

Technically, the retirement sum will be transferred to the CPF members until they run out of balances. However, when considering taking back the retirement sum, there are two main ways an elderly Singaporean can follow, namely via the CPF Retirement Sum Scheme or the newly introduced CPF LIFE. Let’s talk about these two withdrawing methods in detail.

Retirement Sum Scheme

As this scheme focuses on the amount of sum you set aside from your RA account, you have to be very careful about the amount that you have already in store. Also, you will be fully or partially exempted from setting aside a retirement sum of RA for the Retirement Sum Scheme if you are already receiving a pension or lifelong monthly retirement payouts via a private annuity (in cash or through the CPF Investment Scheme). If you have not already enrolled for the CPF LIFE scheme, you can join this scheme between 65 to 80 years. There are three types of retirement sums that you can choose based on your concurrent CPF retirement balance and corresponding payouts if you choose to receive monthly payouts by using this scheme. The three types of retirement sum that you will be qualified by this scheme are:

Basic Retirement Sum (BRS)

Members who own a property that can last them a lease up to at least when they are 95 years old and choose to withdraw the retirement sum (not including earned interest, grants given by the government, top-ups that are provided by the ‘Retirement Sum Topping-up Scheme’ ), they would be set with a BRS.

Full Retirement Sum (FRS)

Members who do not own a property or choose not to withdraw the retirement sum at once (not including earned interest, grants given by the government, top-ups that are provided by the ‘Retirement Sum Topping-up Scheme’), would be set with an FRS. The FRS amounts to two times the BRS amount, and it can be received as full monthly payouts starting from the member’s 65th birthday.

Enhanced Retirement Sum (ERS)

Members who are anticipating receiving higher payouts can set aside this retirement sum which amounts to three times the BRS; this option will accrue more savings in the member’s CPF LIFE.

Given below is a table of the retirement sums that CPF members could receive in different years of their 55th birthdays.

| Year of celebrating 55th birthday | BRS (Basic Retirement Sum) in S$ | FRS (Full Retirement Sum) in S$ | ERS (Enhanced Retirement Sum) in S$ |

|---|---|---|---|

| 2016 | 80,500 | 161,000 | 241,500 |

| 2017 | 83,000 | 166,000 | 249,000 |

| 2018 | 85,500 | 171,000 | 256,500 |

| 2019 | 88,000 | 176,000 | 264,000 |

| 2020 | 90,500 | 181,000 | 271,500 |

| 2021 | 93,000 | 186,000 | 279,000 |

As you can see, with time the retirement sums requirements are set to higher amounts which are not appealing to many CPF members, but it is inevitable compared to the concurrent values of monies.

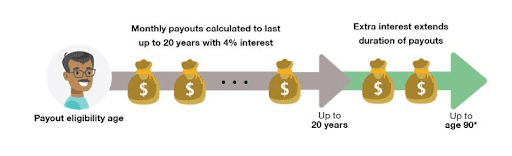

If you are turning 55 in 2021, in 2031 (at the age of 65) -based on your retirement sum- your monthly payout will be calculated under this scheme as follows:

- The current savings will be calculated to last for 20 years

- A basic interest of 4% will be added every year

- An additional 2% will be added by the government when you extend for more than 20 years

CPF LIFE (CPF Lifelong Income for the Elderly)- The Alternative Scheme for Retirement Payouts

CPF LIFE Scheme is a retirement annuity plan (a Singaporean longevity insurance scheme) that insures CPF members against draining their retirement savings, but enabling the RA balances to be transferred as monthly payouts as long as they live. If the CPF member is in a dilemma of how much money they should allocate for monthly expenses and that none of the hard-earned money will be overspent, this scheme would come in handy. You will be exempted from applying for this scheme if you do not possess a commercial annuity product that facilitates you with monthly payouts similar to or higher for life.

Features of the CPF LIFE scheme

- The CPF member would be given a monthly payout no matter how long they life

- It is approved by the government, and its returns are high (up to 6% per annum) and risk-free

- Annuities that are provided by the private sector will be subjected to investment market returns

- With more members, longevity risks the costs will be shared out; therefore, lower costs (also costs does not incur for commissions for agents or advertising because it is administered by the CPF Board)

- Even if your outlive your CPF savings, you will still be provided with monthly payouts

You will be automatically enrolled in the CPF LIFE scheme if you are:

- A Permanent Resident or Singaporean Citizen

- And if you are born in 1958 or after,

- And if you have at least S$ 60,000 in your retirement savings before you are 65 years old

You will be notified by the CPF board after you have been chosen to qualify for the benefits provided by the CPF LIFE plan. If you do not meet the basic prerequisites mentioned above even after your 70th birthday, you will be automatically placed in the CPF LIFE Standard Plan where you will be provided with monthly payouts starting at 70 years of age. If you still do not qualify for the second alternative, you will still be able to join the CPF LIFE scheme between the age of 65 to one month before you are 80 (if you are a citizen or PR of Singapore).

Are you struggling to choose the right CPF retirement plan?

As mentioned above, the CPF LIFE will provide lifelong payouts to its members and the remaining CPF premium and the RA balance will be transferred to the member’s beneficiaries upon death. There are three types of monthly payouts that are enabled by the CPF LIFE Scheme, they are:

Escalating Plan

If you are more concerned about the effect inflation rates have on eroding the value of money and increasing the cost of living you can choose this plan. Your monthly payout value will be lower when the paying out begins, but it will be incremented by 2% every year.

Standard Plan

This is the standard CPF LIFE plan; it provides higher payouts with a fixed budget; the concern is that when time passes, you will be able to buy less since the cost of living rises gradually.

Basic Plan

This plan allows lower monthly payouts and will progressively be lower later on too.

Benevolent CPF Contributions For Social Wellbeing?

- Lending a helping hand to build resilient and strong families in every community

- Supporting vulnerable seniors in every community

- Empowering youth and children who need special care and support

- Helping adults with disabilities to integrate with the society

- Assisting people with mental health disorders

The SHG Funds accrued by CPF Contributions by Employees

When CPF contributions are being accrued in CPF accounts, an unpopular transfer that is not known by many also takes place; namely, SHG (self-help group) funds have taken place. Depending on which community the CPF member belongs to, a portion of their CPF contributions will be donated in the form of SHG funds. Singapore has multiple diverse ethnicities because it is blessed with citizens and PRs from different communities. Being a multi-ethnic country, the financial assistance schemes also includes a protocol where a small number of funds are pooled from each CPF account to support the low-income households in the diverse communities of Singapore.

| The Name of SHG Fund | The Corresponding Community Aided |

|---|---|

| SINDA- Singapore-Indian Development Association Fund | Indian Community |

| MBMF – Mosque Building and Mendaki Fund | Muslim Community |

| CDAC – Chinese Development Assistance Council | Chinese Community |

| ECF – Euroasian Community Fund | Eurasian Community |

These donations are voluntary transactions; the CPF member can fill in their relevant SHG forms to halt the SHG fund transfers or to decide how much transfers they would like to allocate for SHG funds per every contribution. The payslips would display the specifics of SHG funding where a certain rate would be imparted for the member’s corresponding community fund. Also, the rates of SHG funds remain to be fixed for many years (last amended in 2015) and are rarely adjusted. The amount that will be default transferred as your donation depends on your total monthly wage amount. Let us have a quick look at each of these funds separately to get a better idea of SHG funds.

SHG fund for the Indian Community

The SINDA Fund was a beneficiary group that was founded in 1992 to benefit a variety of Indian descendants: “including Bangladeshis, Bengalis, Parsees, Sikhs, Sinhalese, Telegus, Pakistanis, Sri Lankans, Goanese, Malayalees, Punjabis, Tamils and all people originating from the Indian sub-continent”. Their assistive measure mainly focuses on the three assistance: aspirations, education and parenting. Working Indians who are either a citizen, PR or employment pass holders will contribute an SHG amount that is allocated for Indian self-help programmes. Given below are the donation amounts that an Indian CPF member would fund depending on their total wages (sum of ordinary wages and additional wages).

| Total Wages per month (S$) | SINDA amount (S$) |

|---|---|

| 1000 or less | 1 |

| 1000 – 1500 | 3 |

| 1500 – 2500 | 5 |

| 2500 – 4500 | 7 |

| 4500 – 7500 | 9 |

| 7500 – 10000 | 12 |

| 10000 – 15000 | 18 |

| 15000 or more | 30 |

Connect with Singapore Indian Development Association (SINDA) to learn more about the SINDA’s CPF Funds via 1800 295 3333 or mail to [email protected]

SHG fund for the Muslim Community

MBMF was initially formed as MBF (Mosque Building Fund) in 1975 and later in 1984 was addressed as MBMF. The limited housing capacities for the Muslim resettlers brought up the urgent need for building mosques to provide safe accommodation for the Muslim community, which resulted in the forming f the SHG. Families, Madrasahs and mosques are being assisted with the MBMF funds to strengthen the community with strong religious and educational initiatives to suffice the socio-religious needs. Given below are the donation amounts that a Muslim CPF member would fund depending on their total wages (sum of ordinary wages and additional wages).

| Total Wages per month (S$) | MBMF amount (S$) |

|---|---|

| 1000 or less | 3 |

| 1000 – 2000 | 4.5 |

| 2000 – 3000 | 6.5 |

| 3000 – 4000 | 15 |

| 4000 – 6000 | 19 |

| 6000 – 8000 | 22 |

| 8000 – 10000 | 24 |

| 10000 or more | 26 |

Connect with Mosque Building and Mendaki Fund (MBMF) to learn more about the MBMF’s CPF Funds via 6359 1199 or mail to [email protected]

SHG fund for the Chinese Community

CDAC was a non-profited self-help ground that was collaboratively formed in 1992 by SFCCA (Singapore Federation of Chinese Clan Associations) and SCCCI (Singapore Chinese Chamber of Commerce and Industry). This group was established to balance the social mobility of the Chinese Group by providing assistance to the less privileged Chinese people living in Singapore. Given below are the donation amounts that a Chinese CPF member would fund depending on their total wages (sum of ordinary wages and additional wages).

| Total Wages per month (S$) | CDAC amount (S$) |

|---|---|

| 2000 or less | 0.5 |

| 2000 – 3500 | 1 |

| 3500 – 5000 | 1.5 |

| 5000 – 7500 | 2 |

| 7500 or more | 3 |

Connect with the Chinese Development Assistance Council (CDAC) to learn more about the CDAC’s CPF Funds via 6841 4889 or mail to [email protected]

SHG fund for the Eurasian Community

The precursor of the ECF association was the Eurasian Literary Association which was formed in 1918, with the political and economic turmoil the objectives of the association changed. It is believed that the Euroasian groups have heritages dating back to the second world war. However, it was legally accorded as a ‘Self-Help Group’ in 1994. Given below are the donation amounts that a Eurasian CPF member would fund depending on their total wages (sum of ordinary wages and additional wages).

| Total Wages per month (S$) | ECF amount (S$) |

|---|---|

| 1000 or less | 2 |

| 1000 – 1500 | 4 |

| 1500- 2500 | 6 |

| 2500 – 4000 | 9 |

| 4000 – 7000 | 12 |

| 7000 – 10000 | 16 |

| 10000 or more | 20 |

Connect with Eurasian Community Fund (ECF) to learn more about the ECF’s CPF Funds via 6447 1578 or mail to [email protected]

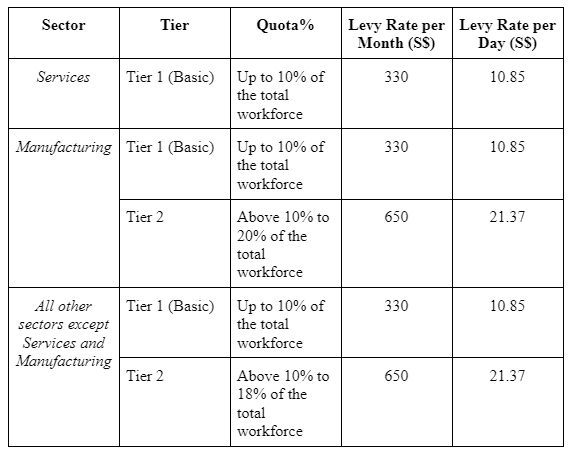

Fees levied from Employers on top of their CPF Contributions

When hiring employees, there are certain levies that an employer will be subjected to based on their employee’s skills and nationality. Here are two types of levies that are entitled to certain employers, apart from contributing to their employee’s CPF contributions.

FWL – (Foreign Worker Levy)

This levy is imposed to regulate the number of foreign employees in Singapore; the employer (even though not obliged to pay CPF contributions to foreign workers) is legally bound to pay it off every month for the foreign employee’s S Pass and Work Permit via GIRO (General Interbank Recurring Order). The CPF Board administers the collection, wavering off and refunding processes of FWL on behalf of MOM (Ministry of Manpower).

So how is the FWL calculated? There are some elements that are pre-assessed before calculating the levy; they are:

- Company/ Service Sector or Pass Type

- Worker’s Status – skilled or unskilled

- Dependency Ratio Ceiling (DRC) – dictates the most appropriate levy ratio based on the employee’s status, qualifications and number of employees.

Mainly, the FWL rates fluctuate based on the sector of employment (Manufacturings, Services. Construction, Process and Marine Shipyard). Given below are the Foreign Worker quotes ratios that are currently entitled to each sector;

| Name of Sector | Quota (%) |

|---|---|

| Manufacturing | 60% |

| Services | 35% (on 1st of January 2021) and 10% for S Pass sub-DRC (since 1st of January 2021) |

| Construction | 87.5% |

| Process | 87.5% |

| Marine Shipyard | 77.8% |

You can use the Quota Calculator in the MOM official site if for quicker FWL computation.

Levy Rates Per Sector

The employers who employ foreign workers or domestic foreign workers can apply to waive off if they meet the eligibility criteria to waive off FWL payments. The employer can initiate the exemption process by filling out an online waiver application before a year passes from the date the levy is being charged. If the employer has overpaid the FWL levies and the employee is no longer servicing in his/her company, the employer can refund the excess amount by submitting an online refund application.

SDL – (Skills Development Levy)

The SDL levy is a mandatory expense the employer will have to bear on behalf of all his employees (local and foreign employees working as part-time, casual, permanent or temporary workers) working in Singapore (exclusive to FWL and CPF contributions). The CPF Board is responsible for the collection, ceasing and refunding processes of SDL on behalf of SSG (SkillsFuture Singapore Agency) and directly channels the collections to the SDF (Skills Development Fund). This levy upheaves the workforce upgrading programmes and provides for the training efforts exerted by the National Continuing Education Training system.

So how is the SDL payable deduced and charged by employers? The SDL Act says that is required by all employers to contribute for SDL funds up to S$ 4500 of each employee’s total wage (sum of ordinary and additional wages) at a minimum contribution of S$ 2 (if total wage amounts to S$ 800 or less) or at a levy rate id 0.25% if the total wage exceeds S$ 800. After you compute all the SDL contributions that you owe to all your employees, you have to sum it down to the nearest dollar. For example, the sum of SDL payable by an employer to his employees is S$ 50.75; the ‘Total SDL Payable will be rounded down to S$ 50. Click here to direct you towards an SDL payables Calculator.

An Employer can pay the SDL payable amount along with his or her CPF contributions, but if the employer’s staff are all foreign employees, he or she can directly settle the SDL contributions in the SSG since the employer is not entitled to CPF contributions. To request a refund for overpaid SDL contributions, you can visit the SSG website or connect their call centre via 6785 5785.

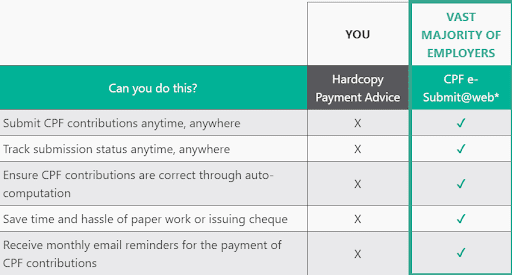

CPF Contribution Submission by Employers

As we discussed before, employers will withhold an amount (employee’s CPF contribution) and add the employer’s contribution and related levy wages as necessary and submit them to the CPF Board. Employers are encouraged to submit their employee’s total CPF contributions electronically via the free web-based software, namely CPF e-Submit@web, which is integrated with auto-generated CPF and SDL calculating tools. The employer can register to this portal via their CorpPass or SingPass. The CPF contributions can be made via eNETS or Direct Debit. The image below is a screenshot captured from the official site of the CPF Board to illustrate the advantages of using CPF e-submit@web.

Check whether you qualify all the following points to submit CPF contributions successfully via this e-submission method.

You should possess a CorpPass or SingPass

You need a computer with internet connectivity

You should have a workable email address

You must be familiar with with one of the approved modes of payment (Direct Debit or eNETS)

You must be a registered user in the CPF Board

New Employer? Here’s what you need to know…

Rookie employers must submit their contributions and details using the CPF e-submit@web after their first recruitment. To apply for a SingPass or a CorpPass, they must already have a UEN allocated for their name. An email notification will be sent to ensure that the employer’s application has been approved plus a hard copy welcome letter will be delivered to the employer’s address with the assigned *CSN (CPF submission number) and Direct Debit Authorisation Form. Also, once the CPF contribution is transferred on a valid date and completely processed with no discrepancies, an electronic record of the payment link will be sent.

*The CSN is a unique code given to an employer to transact with the CPF Board; it is formed by combining the employer’s UEN and CPF payment code.

Given below is a flash guide that you can use to follow when submitting the CPF details of your employees via CPF e-Submit@web.

- Click here to login to the CPF e-Submit portal via either your CorpPass or SingPass and CSN.

- In the Main Menu Click on ‘Submit Contribution’

- Then select ‘CPF e-Submit@web’

- Enter the month and year of the submissions

- Click on ‘Submit via Blank Form’

- Key in all required details

- Click on ‘Continue’

- Confirm clicking on your prearranged payment mode with the CPF board

You also have an alternate payment option; you can pay via the PAT system. This method is an alternative for employees without payroll systems to create employee databases and proceed to settle shortfall and back-dated CPF contributions for the current and the last five years. Once you create your employee database via PAT, please follow the following instructions to submit CPF contributions via the PAT system.

Instructional Series 1: Creating a backdated or Short Pay Payment Advice

- Click on ‘Payment Advice’ and then select ‘Create’

- Select your CSN and respective month of CPF Contribution

- Click on ‘Create New’ on the second step

- Click on the Continue Button

- Key in your employee groups accordingly and hit the ‘OK’ button

- Select ‘No’ for Question 1 and Question 2

Instructional Series 2: Payment Advice for submitting CPF contributions

- Click on the ‘Add/Modify’ button to add or modify employee records

- Click on ‘Add/New’ to see the payment advice of the existing employees’ search page

- Undergo a partial check by keying information and generating search results

- Select one of your employees and hit on ‘Retrieve’

- Edit the necessary field as required

- Hit on ‘Add New’ to save details and redo the same to all employees

- Click on the ‘Close’ button when you are done.

- Press the‘ Summary’ button to view a summated window of the payment advice information

- Click on ‘Save’ if the information entered is precise, click on ‘Refresh’ to reflect computations if it’s not updated

- Click on ‘Return’, and your payment advice will be saved

- Click on ‘Yes’ to submit payment advice to the CPF Board

- Click on ‘Submit’

- You can now create new payment advice by clicking on the ‘Return’ button

The above two sequel series are explained graphically in this User Guide (https://pat.com.sg/govt/cpf/html/forms/Short_Pay_PA_Creation.pdf). For more clarification, connect to CrimsonLogic by dialling 68877888 or visiting the PAT system site (https://pat.com.sg/ )

All You Need to Know About Direct Debit

You can make all your payments via Direct Debit to the CPF Board after you submit your employee’s CPF details via CPF e-Submit@web or the PAT system you can select your favoured data (and time) of deduction to transfer your contributions every month via Direct Debit. The currently available deduction dates are:

If the submission date is from the 1st to 12th month – the deduction dates are available from the 3rd working day upon e-submission to the final day of the grace period given by the CPF Board (Note: the CPF Board provides a Grace Period of 14 days to pay the contributions start from the month’s end; also, of the 14th day, not a working day the grace period will be extended to the next closest working day). Late payments will be charged a monthly interest of 1.5% starting from the first due date.

If the submission date is after the 12th month – the deduction dates are available from the 3rd working day upon e-submission (no grace period is given)

Fill in this form to enrol yourself to pay CPF Contributions via a Direct Debit authorisation.

More than 100,000 employers use Direct Debit to settle their CPF Payments every month

Amendment or Deletion of Submitted CPF Contributions

You can amend or delete your e-submission if you have made any erroneous transfers as your CPF payments. Either way, it is crucial that you re-submit in a valid time frame (before the deadline) to avoid needless adding up of delayed interests and your amended submission will be saved as a draft and will not be sent for Direct Debit Deduction. Please follow the steps given below to amend or delete your CPF payments.

- Login to CPF e-Submit.

- Enter your CSN (CPF Submission Number)

- Log in using your CorpPass or SingPass ID and password

- You will be channelled to the CPF e-Submission home page after login authentication.

- Select ‘View / Amend / Delete Submission’ which is under the Employer Contribution section.

Now follow the following to Delete CPF Payment

- Check the box/es to select the contribution details that need to be deleted.

- Hit on ‘Delete Submission’

- Click on OK when the pop-up message displays, “You are about to delete the selected submission record. Do you want to continue?”

- Read and close the confirmation messag

Or, follow the following to Amend CPF Payment

- Hit on Amend.

- Tap on OK when the pop-up message displays “This submission will not be processed if you amend the submission record. Please re-submit the record after amendment. Do you want to continue?” to proceed.

- Change or edit the fields in the Submission of Contribution Details Page that needs to be amended.

- Press on ‘Save Draft’ if you are still not ready for your file submission. A confirmation message saying “Draft saved successfully” will be displayed.

- Hit on ‘Continue for Confirmation & Payment’ to submit the amended file.

Proactive Contact Services to Inquire about CPF Complications

If you have any clarifications yet to be resolved or any doubts about your CPF processings you can contact the CPF board in either one of the following connecting ways:

- Via the Portal: MyCPF Online Service where you can submit querying addressing your inquiry via ‘My Mailbox’.

- You can connect with the CPF hotline (operating hours 8: 00 AM to 5: 30 PM on the weekdays):

- If you are a Singaporean connect to 1800-227-1188

- If you are from overseas connect to +65-6227-1188

- You can submit a web form.

- Employees can make an appointment (https://www.cpf.gov.sg/Members/Contact/visit-us) to visit in person to any of the CPF Centres based in Jurong, Woodlands, Tampines, Pagar and Bishan.

Summary

This well-versed Tigernix guide encompasses every detail that a Singaporean employer or employee must be apprehended about CPF contributions because you know that understanding the CPF processes and being well-aware of each CPF levy and fund transfer can be daunting to many working people. Please connect with our Tigernix Support Centre to learn about how our software solutions can supercharge your payroll generations and integration with well-tested in-build CPF, levies and fund calculators.