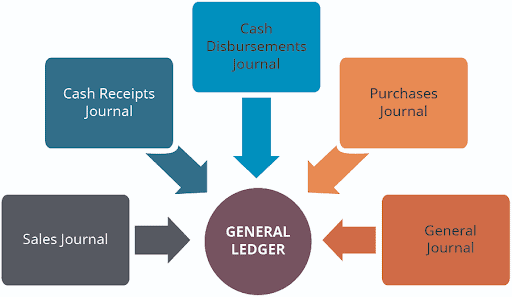

This is where the need for a special journal is most highlighted. The special journal, which is also named ‘the specialised journal’, documents multiple lines separately and allows the accountant to transfer a single line of record to the general ledger. It reduces the tedious account recording tasks by helping the accountant overlook the unnecessary recording of separately posting repetitive transactions in a concise manner.

Types of Special Journals

Many companies have different types of special journals; like:

- Bills Payable Journal

- Bills Receivable Journal

- Cash Payments or

- Disbursements Journal

- Cash Receipts Journal

- Journal Proper or General Journal

- Purchases Journal

- Purchases Returns and Allowances Journal

- Sales Journal

- Sales Returns and Allowances Journal

Here are a few of the most used Special Journals explained below.

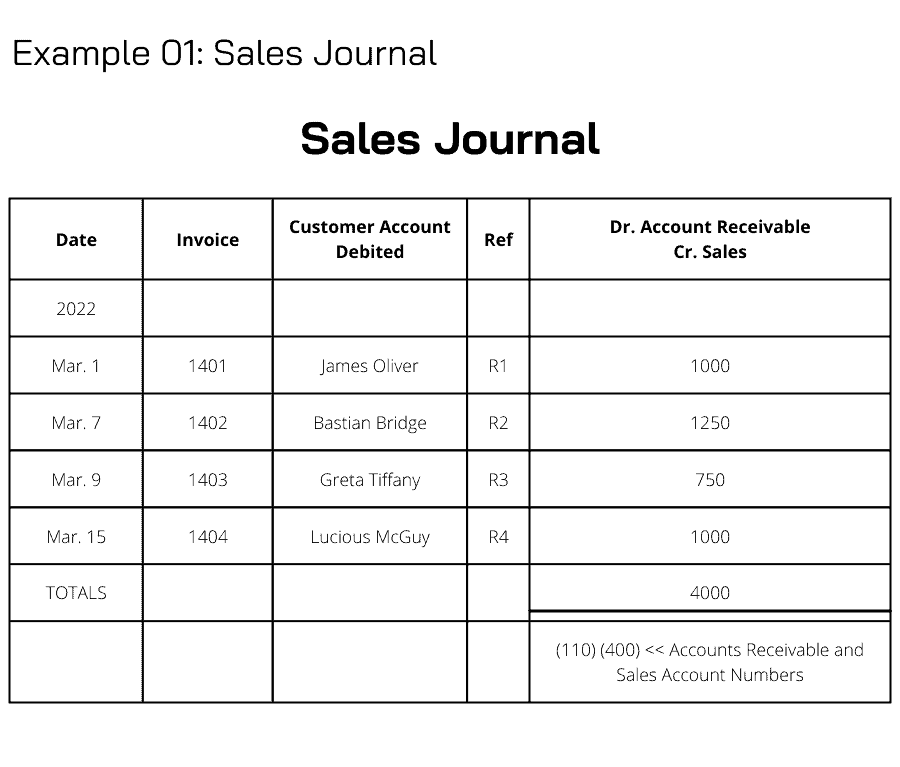

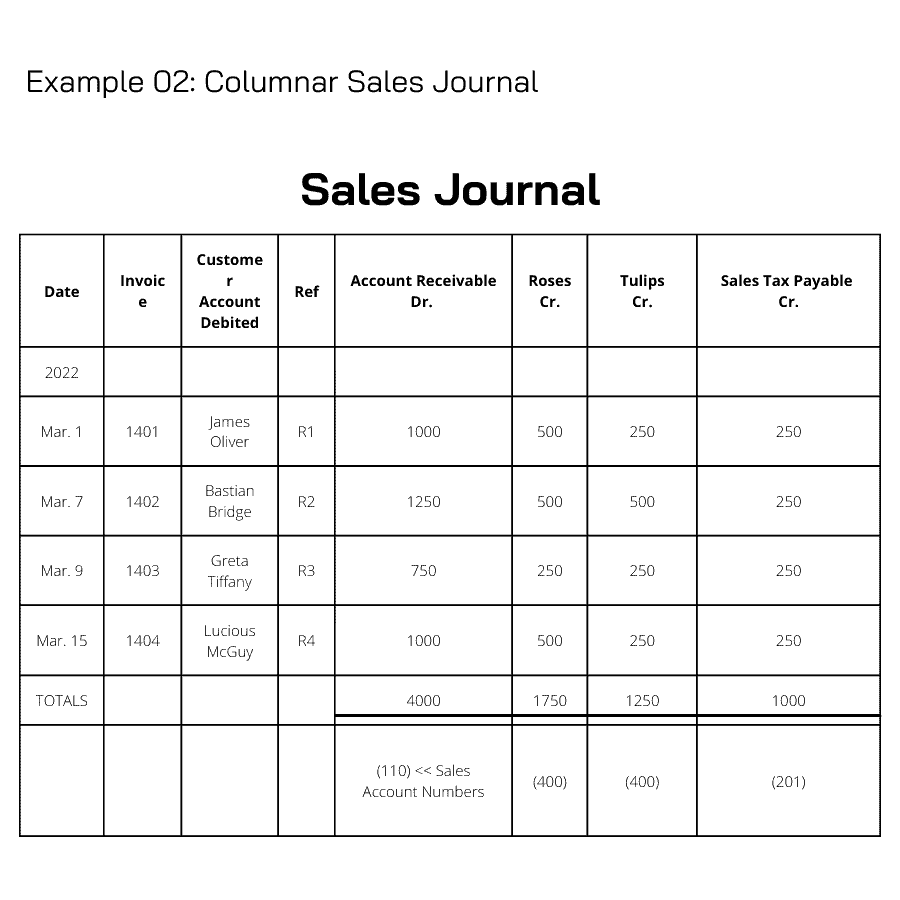

Sales Journal

The columnar styles of the sales journal differ based on the purposes of the company. Some companies use multi-columns sales journals for specific sales accounts and sales tax payable accounts.

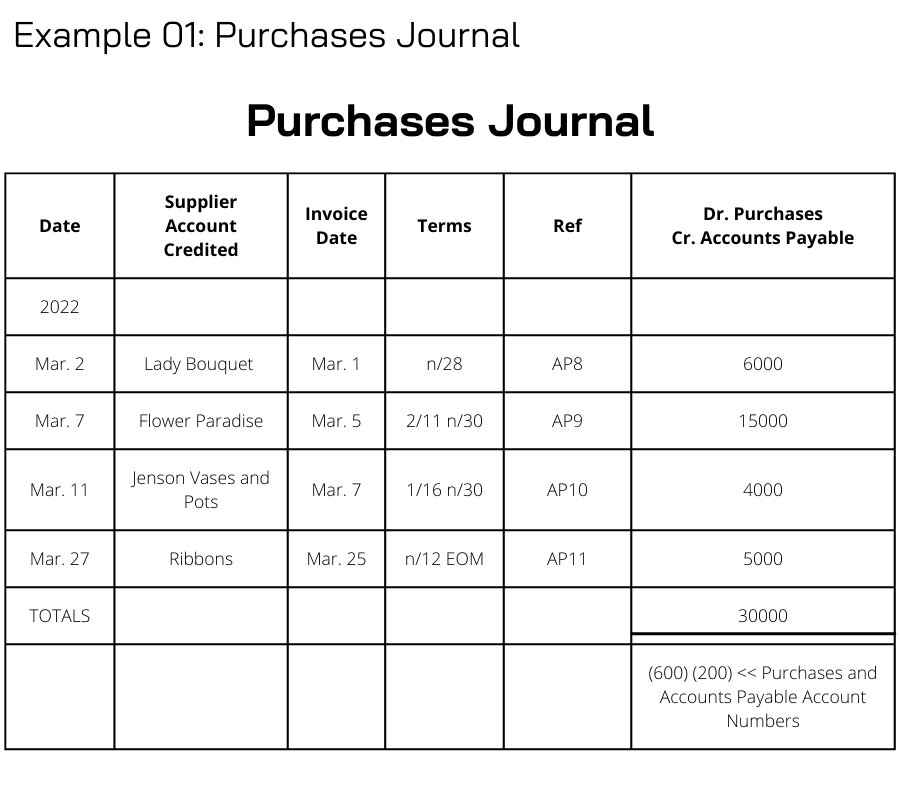

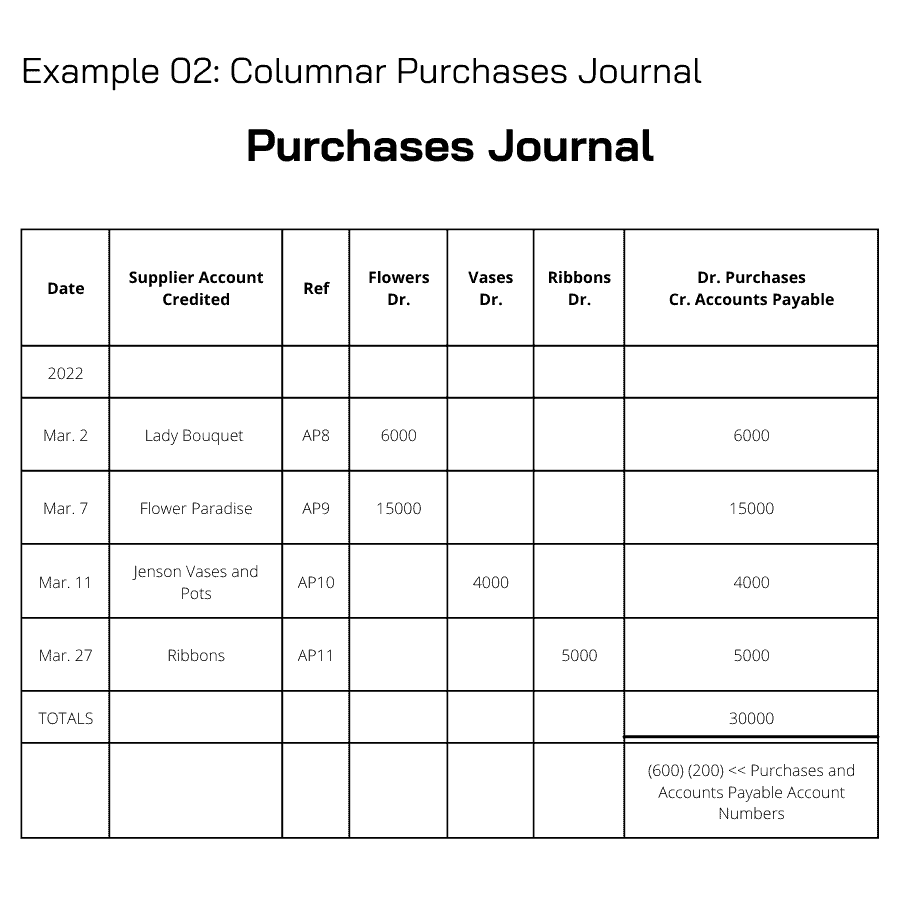

Purchase Journal

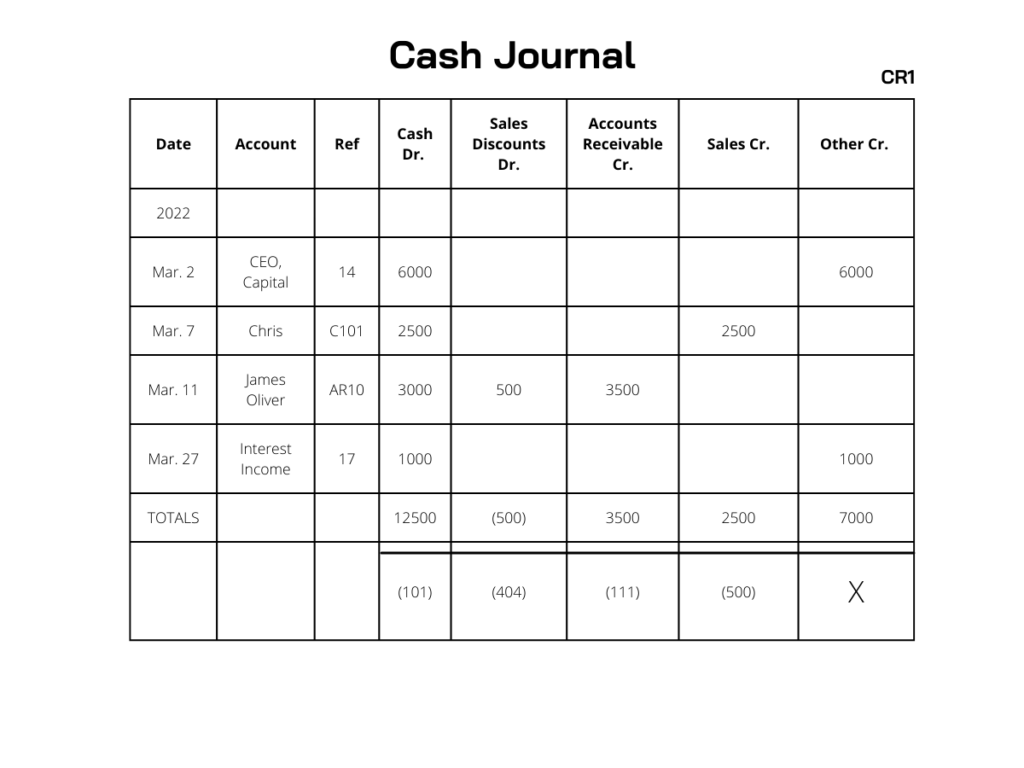

Cash Receipts Journal

This special journal uses a multi-column frame to record the cash increments and discounts given to clients. It records:

- Sales Discounts Offered to Customers: Debit Sales

- Accounts Receivables: Debit Account Receivables and Credit Sales Account (Can use multiple columns to explain the nature of the transaction). These transactions are updated daily by the accountant in the subsidiary ledger and the journal hand in hand.

- Other: Infrequent cash receipts like bank loans, interest revenue (can have multiple columns and capital investment).

- Account: Records the credit entries that appear in the Other Account or Accounts Receivables Account.

At the end of the accounting year, all columns are posted in the general ledger as in single records- summarising the general ledger and avoiding it from being lengthy. Exceptionally, an ‘X’ is written under the Other column to mention that the total cannot be posted to the general account.

This special journal uses a multi-column frame to record the cash increments and discounts given to clients. It records:

- Sales Discounts Offered to Customers: Debit Sales

- Accounts Receivables: Debit Account Receivables and Credit Sales Account (Can use multiple columns to explain the nature of the transaction). These transactions are updated daily by the accountant in the subsidiary ledger and the journal hand in hand.

- Other: Infrequent cash receipts like bank loans, interest revenue (can have multiple columns and capital investment).

- Account: Records the credit entries that appear in the Other Account or Accounts Receivables Account.

At the end of the accounting year, all columns are posted in the general ledger as in single records- summarising the general ledger and avoiding it from being lengthy. Exceptionally, an ‘X’ is written under the Other column to mention that the total cannot be posted to the general account.

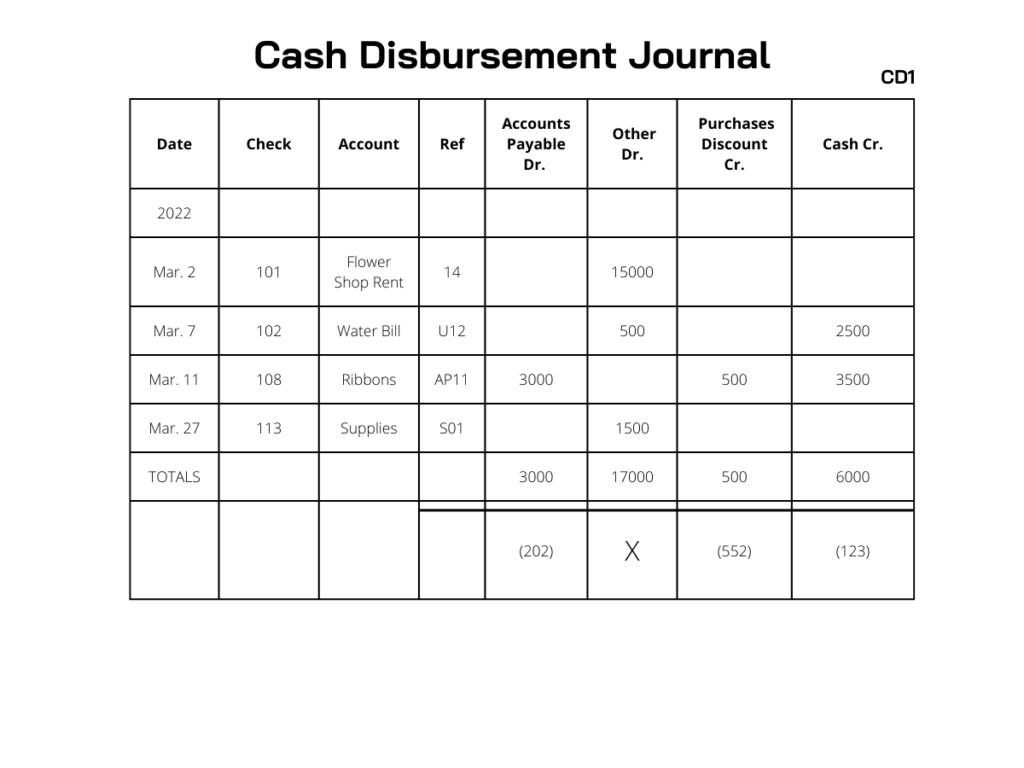

Cash Disbursements Journal

These company transactions will determine in which column they must be recorded, like depending on the type of transaction (salary expenses, commissions or other accounts that affect the Cash Disbursement Journal) will be recorded in the right column every time the transaction is made.

At the end of the accounting year. The total of the columns will be updated as single records in the General ledger except for the Other account. To indicate this, an ‘X’ is indicated in the parentheses of the journal.

General Journal

Automate Your Special Journal Entries with Tigernix Accounting Solutions

The robust and modular software suites of Tigernix that are specialised in many fields of businesses, including ERP, CRM, POS, E-Commerce Management and more, can be integrated into accounting systems that are already utilised by accounting firms and large-scale companies. We are also ready to personalise all our solutions to fit your accounting requirements and help your organisation to self-reliantly record and report your financial events automatically with lesser efforts and more income! The inbuilt financial systems in our solution are admired by our merchandise clients for their user-friendliness, customizability and integrable features.

Connect with Tigernix to learn why you should not miss out on our accounting integrations and how we can help your accounting and finance department streamline its operations every day. Your financial viability will never be suffering from human errors, daunting repetitive records or complex accounting methods anymore.

Special Journals of The Future

Human-maintained financial accounts, books, journals and reports are now a thing of history. Many companies are using computerised systems to keep track of every transaction in their establishments automatically. These software suites will follow the same accounting principles using trained models to update transactions in their relevant general, special or individual journals for financial reporting requirements. The future of accounting will be fully computerised, where companies can find ways to concise the responsibilities of a team to a single person.