This article will investigate the ins and outs of a specific tax variation levied in Singapore- the Goods and Services Tax or GST. The GST system made its advent to the tax schemes in Singapore to lower all taxes while maintaining an unbiased steady flow of revenue for the Singapore Government. If you are inspired about starting up a business, joining the co-economy or being a partner of an existing company in Singapore, this article will be most important. In other words, if you are not very clear about how the GST system in Singapore works but are planning to register for it, this article is a not-to-be-missed reader-friendly piece of advice to be well-versed about GST. Given below are the respective areas of discussion that outline the article for your referential convenience.

- Introduction

- Types of Supplies

- Types of Purchases

- GST on Imports

- Registration Propaganda

- GST Schemes for GST-registered Businesses

- Collection of GST by IRAS

- Claiming Input Tax

- Volunteer Disclosing of Mistakes Made in GST Returns

- Calculating GST

- How to File GST Returns to The IRAS

- GST Documentation

- GST Accounting

- UEN, ACRA and GTS Numbers

- Conclusion

Introduction

What is GST?

GST, or expanded as ‘Goods and Services Tax’, is a consumption tax levied on the import products (by the Singapore Customs) and almost all supplies- goods and services- transacted in Singapore. In many other countries, the GST is referred to as the Value Added Tax or VAT. Most local products and service transactions in Singapore should be obliged to the terms and conditions of the GST Act.

The introduction of the GST system was first recorded on the 1st of April 1994; it was tailored off the New Zealand GST legislation and UK VAT legislation. GST rates are indirect taxes that can only be charged from the companies that are registered in the GST system. Some companies are mandatory registrants, and the others can be volunteer registrants who agree to certain terms and conditions circulated by the GST Act. But the payee of the tax is usually the end consumers of the products and services, and businesses merely play the role of tax-collecting agents for the Singapore Government.

The first GST rate imposed in 1994 was 3%. It was increased to 4% on the 1st of January 2003 and 5% on the 1st of January 2007. The recent and accepted GST rate caps to 7%; this amendment was made on the 1st of July in 2007. [5] It was announced in 2018 that the future GST rate would increase from 7% to 9% between the years 2021 to 2025. This increment was proposed because the government has to accrue funds for:

- Future infrastructural investments and the maintenance of the existing infrastructures.

- Funds for social spending to help the rising elderly population

Click here to view a descriptive infographic on why Singapore has decided on raising the GST rates to 9%. Also, click here to learn how this increment can facilitate the low-wage earners in Singapore.

The proposed increment was deferred to the next year (2021) because of the COVID-19 pandemic, along with a proposed assurance package worth S$ 6 billion to be proportioned to maintain a reliable fiscal footing to deal with uncertain surprises and scenarios such as the prevailing pandemic.

Also, it is important to note that some of the goods and/or services in Singapore are either exempted or not applicable by GST; they are [6]:

- Exported Goods (0% GST)

- International Service Providing (0% GST)

- Sale or rental of an unfurnished property (not applicable)

- The supply of digital payment tokens (not applicable)

- The providence of financial services (not applicable)

- Importing and supply of IPM or Investment Precious Metals (not applicable)

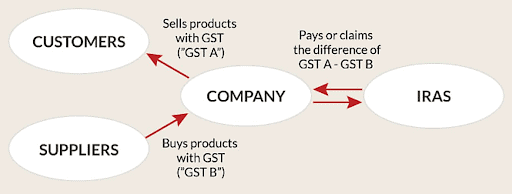

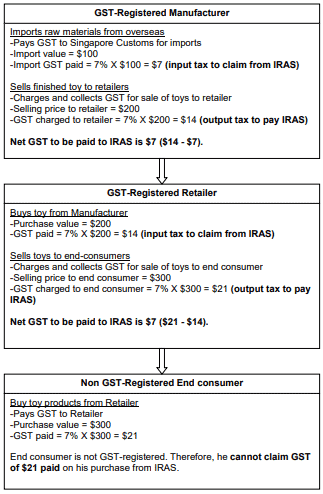

GST registrants can collect the tax from the customers, pay it to the IRAS and claim back the GST credits (or input tax) when purchasing supplies for the business as expenses, but non-registrants do not have this chance. The principle of the GST system for registrants is illustrated below.

Also, it is essential to note the term taxable turnover, which is profoundly used by the documentation of GST-related transactions. ‘Taxable Turnover’ is a term that defines the total value of supplies without adding or deducting the GST tax values. It includes the raw values of taxable supplies, excluding out-of-scope supplies, exempt supplies and sale of capital assets.

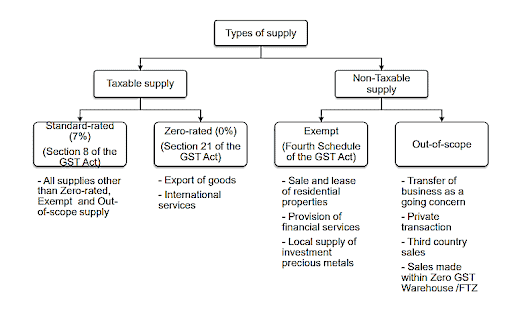

Types of Supplies

Taxable Supplies

7% (current rate) of GST is charged on sales and services provided in Singapore that do not fall under any other supply categories given below.

- Exported Goods (0% GST)

The exporter has the onus of responsibility to supply the required documentation to support the zero-rated declarations made by GST. Such documents may be commercial transaction proving invoices, commercial transportation documents or other issuances(terms and rules are applied here)

- International Service Providing (0% GST)

Some of the international services provided for overseas customers are facilitated by a zero-rate policy, such as international export, transportation and freight services.

Non-taxable Supplies

- Sale or rental of an unfurnished property

- The supply of digital payment tokens

- The providence of financial services – bank charges, currency exchanges, issuing or selling of shares, provision of bank loans, provision of assurances and others

- Importing and supplies that are recognised as IPM or Investment Precious Metals

- GST is not applicable for supplies that are out of the scope boundaries of the GST Act. Supplies that are not placed in Singapore, Employee salaries, third Country sales, trading activities in Free Trade Zones, private transactions, sales of zero-rated GST/licensed warehouses are regarded as out-of-scope supplies.

Deemed Supply

When the assets of a GST registered person are dispensed, taken away or applied for non-business purposes, supplies are named as ‘Deemed Supplies’ even though there is no special consideration received by the GST applicants. The logic behind deeming supplies is the idea of using tax-free assets. Some examples of deemed supplies are:

- fringe benefits given by the GST enrolled companies to their employees,

- the provision of services for employees (T & C applied),

- the complimentary gifts and amenities that are given to customers (T & C applied)

- disposing of aged or unwanted assets.

Tax Code Directory for Output Tax

| Tax Code | Description |

| SR | Standard Rate Supplies |

| ZRL | Zero-Rated Local Supplies |

| ZRE | Zero-Rated Import Supplies |

| ES43 | Incidental Exempt |

| DS | Deemed Supplies |

| OS | Out-of-scope Supplies |

| ES | Exempt Supplies |

| RS | Relief Supplies |

| GS | Disregards Supplies |

| AJS | Adjustment |

Types of Purchases

Standard-rated Purchases

Zero-rated Purchases

Imported Purchases

Import purchases are also qualified in allowing the company to claim the input tax deductions in your GST returns when you submit your tax files to the Comptroller only if you have settled all the payments liable to Singapore Customs. However, purchases imported under a particular purchase scheme, like:

- Imports that qualify for the ‘Major Exporter Scheme’ and ‘Third Party Logistics Scheme’ (“3PL”), GST is deferred when the supplier trades with significant imports such as non-dutiable goods into Singapore. Such Imports bear the tax code: ME.

- Imports under the Import GST Deferment Scheme is where an eligible GST-registrant can suspend the payment of import GST until the company files its GST returns every month where the same amount is claimed as an input tax at the same time.

Disallowed Expenses or Purchase Blocks

When you are a GST-registered entity that spends on a disallowed expense, you become a partial exempt trader, or you are unable to claim back the input tax. But even though you can’t claim, you have to submit the GST returns when you are tax-filing in the IRAS. The expenses given below are regarded as Disallowed Expenses:

- Medical expenditures and medical and accidental insurance premiums given to the staff that are excluded from the Work Injury Compensation Act or not subjected to any meaning risen from the Industrial Relations Act

- Club Subscriptions, Membership fees or transfer fees of entertainment clubs (sports and recreational clubs)

- Benefits provided for the personal needs of your staff

- Travel and maintenance expenses of the business by motor cars that are registered under the business or owners name or hired.

- Expenses in betting, lotteries, fruit machines, sweepstakes or any other games of chance

Non-GST Registered Suppliers

Exempt Purchases

Out-of-scope Purchases

Tax Code Directory for Input Tax

| Tax Code | Description |

| TX or TX7 | Standard Rate |

| IM | Import Goods |

| IS | Imports in the Special Scheme |

| BL | Disallowed Purchases / Purchase blocks |

| NR | Non-GST Supplier |

| ZP | Zero Rate |

| EP | Exempt |

| OP | Out of Scope |

| TX – E43 | Directly to Incidental |

| TX- N43 | Directly to Non-Incidental |

| TX – RE | Not Directly to taxable or exempt trade |

| GP | Disregarded- Group |

| AJP | Adjustment |

GST on Imports

Dutiable Supplies

All dutiable imports are charged with GST, but they are also charged extra with customs and excise duty taxes. Dutiable supplies are goods imported that fall under any of the following categories:

Intoxicating liquor– the customs and/or excise duty taxes will be imposed on the liquor bottle. The tax rates will vary according to the number of litres and alcoholic strength of the liquid.

Tobacco Products– the excise duty will be imposed based on the weight of the tobacco products (in kilogrammes). In cigarettes, the weight of a single stick is multiplied by the number and sticks, and the excise tax will then be imposed on the total.

Automobiles– the customs value of the vehicle and the excise duty rate will be multiplied to get the duties payable for the respective vehicle. For example, if a car is worth S$ 200,000 and the customs charge S$ 3000 worth of insurance and freight costs. The CIF value of the car adds up to S$ 203,000. If the duties payable is 20% of CIF, which is S$ 40,600. Then the GST is calculated as 7% from the subtotal of the CIF (S$ 203,000) plus duties payable (S$ 40,600), which is S$ 243,600. Therefore, the GST (7% of S$ 243,600) is S$ 17,052, and this amount is claimed as input tax.

Biodiesel blends and petroleum products– An excise tax will be charged on Petroleum products by their volume, and compressed natural gases imported to Singapore will be charged with an excise tax on the total weight of the components. In biodiesel blends, the tax will be imposed only on the volume of diesel present in the mixture.

Non-Dutiable Supplies

GST Exemptions on Import

GST will not be imposed on import supplies that are:

- Identified as Investment Precious Metals (No GST payable but must pay for an exempt Permit via TradeNet®)

- Qualified by an Import relief

- Approved under a particular GST scheme

- Landed in the Free Trade Zone or if they do not enter the customs territory and imported directly into a licensed or zero GST warehouse

Claiming GST Receivables for Imports

Under the conditions of claiming input tax in the GST system, you are permitted to claim the GST that you pay to Singapore Customs for your imported supplies. Import permits must support the input tax claims, which supports the claim by showing you as the legal importer of the goods. If the name of the importer was misinformed, please refer to mistakes in import declarations to learn what you must do to amend the errors in your import documents

GST Reliefs on Imported Supplies

Claiming GST on Goods Re-importation for Local customers and GST-registered Overseas Customers

Registration Propaganda

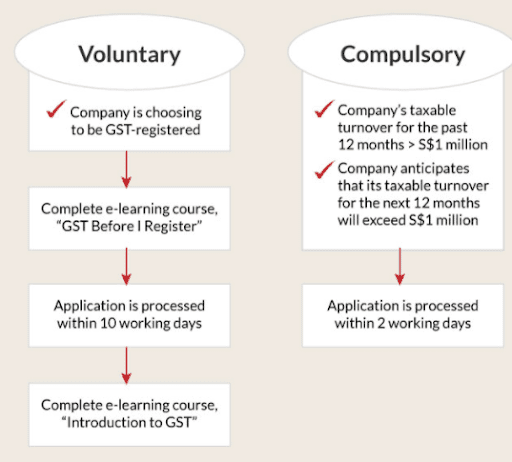

The first step for registering in the GST system is identifying the type of GST registration that your company must follow. GST registrations can either be voluntarily done by the businesses or is compulsorily self-registered by the companies. The image below illustrates a briefing of these two types.

Voluntary Registration for GST

Depending on the company operations, your business can also register into the GST system even if you are not liable to a mandatory register in the system. If you are a company in Singapore that is trading taxable supplies or is planning to transact with taxable goods, you can enrol in the GST Scheme under specific terms and conditions that must be followed by a volunteer registrant. One of the conditions that you are agreeing by registering to the system is that you remain under the system’s obligations for at least two years while doing the related duties as required like tax filing without delays on a quarterly basis, maintaining records for at least five years even if your company is terminated or de-registered by the GST system and any other additional conditions that are later imposed by the IRAS. Voluntary registrants will also have to complete two e-Learning courses, namely ” Registering for GST” and ” Overview of GST”, and take part in the quizzes. One course must be completed before the GST application is processed and the other after. The passing score of these courses is 80%. Taking the courses are not compulsory if the applicant knows about managing a GST-registered business. Also, if the person in charge of your GST returns is an Accredited Tax Practitioners (ATP) or Accredited Tax Advisers (ATA) or if the company is registering under the Overseas Vendor Simplified Pay-only Registration Regime.

Compulsory Registration for GST

According to the retrospective basis, if the company has gained more than S$ 1 million in the 12 months before GST registration, the business is obligated to register in the GST system. Another aspect is said by the prospective basis, which denotes that if you are estimated to have a revenue of more than S$ 1 million for the next 12 months, maybe you signed a contract or gained an opportunity. Your company will also have to be liable to be registered in the GST system. In any of these scenarios, the company, if compulsory GRT- registered parties identify them, will have to apply within 30 days to the IRAS.

Two new amendments arose: the need for compulsory registration for Overseas Vendors and a regime for reverse charge. These new regimes are explained below:

Reverse Charge Regime: If your business is procured by overseas service suppliers and if your business would not be entitled to full input tax credit even if you were GST-registered

Overseas Vendor Registration Regime: If you are a supplier based overseas or an overseas or local e-marketplace operator that enables digital services in Singapore, you will be liable for GST registration.

Click here to learn more about GST on Imported Services.

Suppose the company fails to register within the required time frame. In that case, it will be penalised, and anti-avoidance provisions are used to guarantee that entities are not falsifying by keeping their company turnovers less than the threshold and thereby avoiding registration. Late registration will face serious consequences such as:

- Backdating your registration date to the day which you are legally bound to register

- Starting from the backdated day; you will have to pay GST for the prior sales within the period. Not collecting GST from customers during this period does not rectify you for not paying the GST for the missed period; therefore, either way, you have to pay the tax.

- You may even face a fine for avoiding your duty which can cost up to S$10,000 and a penalty equal to 10% of the due tax payment.

- Prosecution action may be applied in some scenarios too.

Summarised Steps to Register in The GST System

Once you determine which tax propaganda you fall under, you can follow the easy steps given below to register in the GST scheme.

- Log in to the myTax Portal >> GST>> Register for GST or go to www.iras.gov.sg >> Quick Links>> Forms >> GST >> GST registration.

- Verify and explain the nature of your business

- Provide the necessary information on your supplies

- Select your accounting period and complete the questionnaire

- Disclose all information about GST collected before registration

- Attach all necessary documents and submit the application form

- View and save the acknowledgement on page

- Check for the notification received on the GST registration.

Watch this video to have a well-versed understanding of the GST registration process.

In What Instances are You Exempted From Registering?

How Can You De-register Your Business?

GST Schemes for GST-registered Businesses

GST tax schemes are available for companies that are already registered in the GST tax system. Some schemes require prior approval by the IRAS, and others do not require approval. Contact your trust tax specialist to make sure that you are following the most profitable GST scheme. A chart given below was posted by singaporecompanyincorporation.sg shows the 8 GST schemes of the IRAS.

| GST Scheme | Description |

|---|---|

| Cash Accounting Scheme | Companies can account for output tax upon receipt of payment from customers and input tax is claimed only upon payment to suppliers |

| Discounted Sale Price Scheme | GST charged 0n 50% of the sale price of a second-hand or used vehicle |

| Gross Margin Scheme | GST is accounted for on the gross margin, instead of the full value of the goods supplied. This is beneficial for second-hand dealers who purchased goods free of GST |

| Hand-Carried Exports Scheme | Companies can zero-rate their supplies to overseas customers for goods hand-carried out of Singapore via Changi International Airport only |

| Import GST Deferment Scheme | Approved GST-registered businesses can defer their import GST payments until their monthly GST returns are due, as long as they file their GST returns on a monthly basis |

| Major Exporter Scheme | Companies are allowed to enjoy GST suspension when importing non-dutiable goods at the point of import and zero GST warehouses |

| Tourist Refund Scheme | Companies that are in the Tourist Refund Scheme (“TRS”) can grant tourist GST refunds |

| Zero GST Warehouse Scheme | Import GST on non-dutiable overseas goods is temporarily suspended, until the imported goods leave the warehouse and enter the local market |

Apart from the schemes explained above, there are seven other remaining GST schemes enabled by IRAS, are:

- Approved Import GST Suspension Scheme (AISS)

- Approved Marine Fuel Trader (MFT) Scheme

- Approved Contract Manufacturer and Trader (ACMT) Scheme

- Approved Refiner and Consolidator Scheme (ARCS)

- Approved Marine Customer Scheme (AMCS)

- Tourist Refund Scheme (for retailers)

- Approved Third-Party Logistics (3PL) Company Scheme

Collection of GST by IRAS

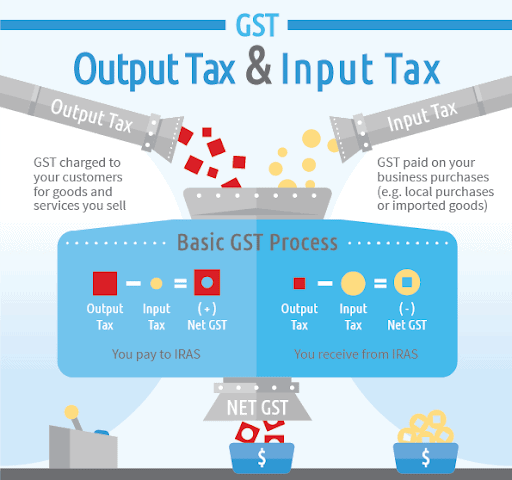

The authoritative governing body that collects GST in Singapore is the Inland Revenue Authority of Singapore (IRAS). This authority houses all fundamental income managing agencies into one place. It is responsible for collecting property tax, GST, income tax, stamp duties and more. It is the main body in the Ministry of Finance and has the propensity to formulate tax policies too. If net GST is positive, where the output tax overrides the input tax, the difference between the two is the amount that is payable by you to IRAS. The scope that covers the GST events is mentioned in the ‘Section 7’ of the Goods and Services Act is laid under two main sections:

GST on The Goods and Service Supply in Singapore

Taxes are imposed on taxable supplies made in Singapore by a taxable person for a business purpose only. At the supply of Goods and Services in Singapore: GST collected by the registered suppliers and paid to the Comptroller of the authorities. The registered companies must pay to the authorities every quarterly by a method known as ‘tax filing’. In this process, you report both:

Input Tax: GST charged to customers who buy your supplies

Output Tax: GST you pay for businesses purchases

The difference of taxes, namely Net GST two, is either paid to or by the Inland Revenue Authority of Singapore (IRAS).

GST on Imported Goods in Singapore

Claiming Input Tax

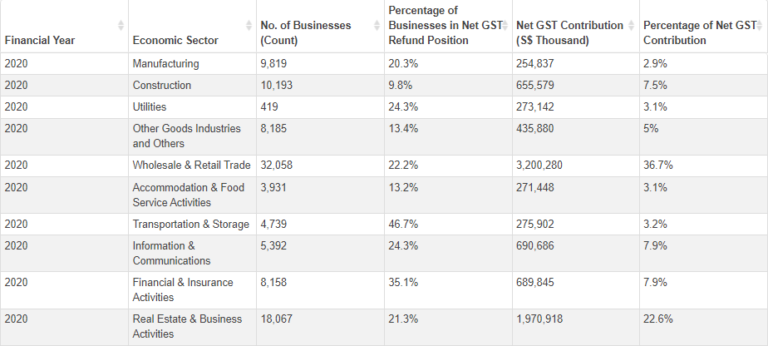

Statistics for NET GST in 2019 in the Economic Sector

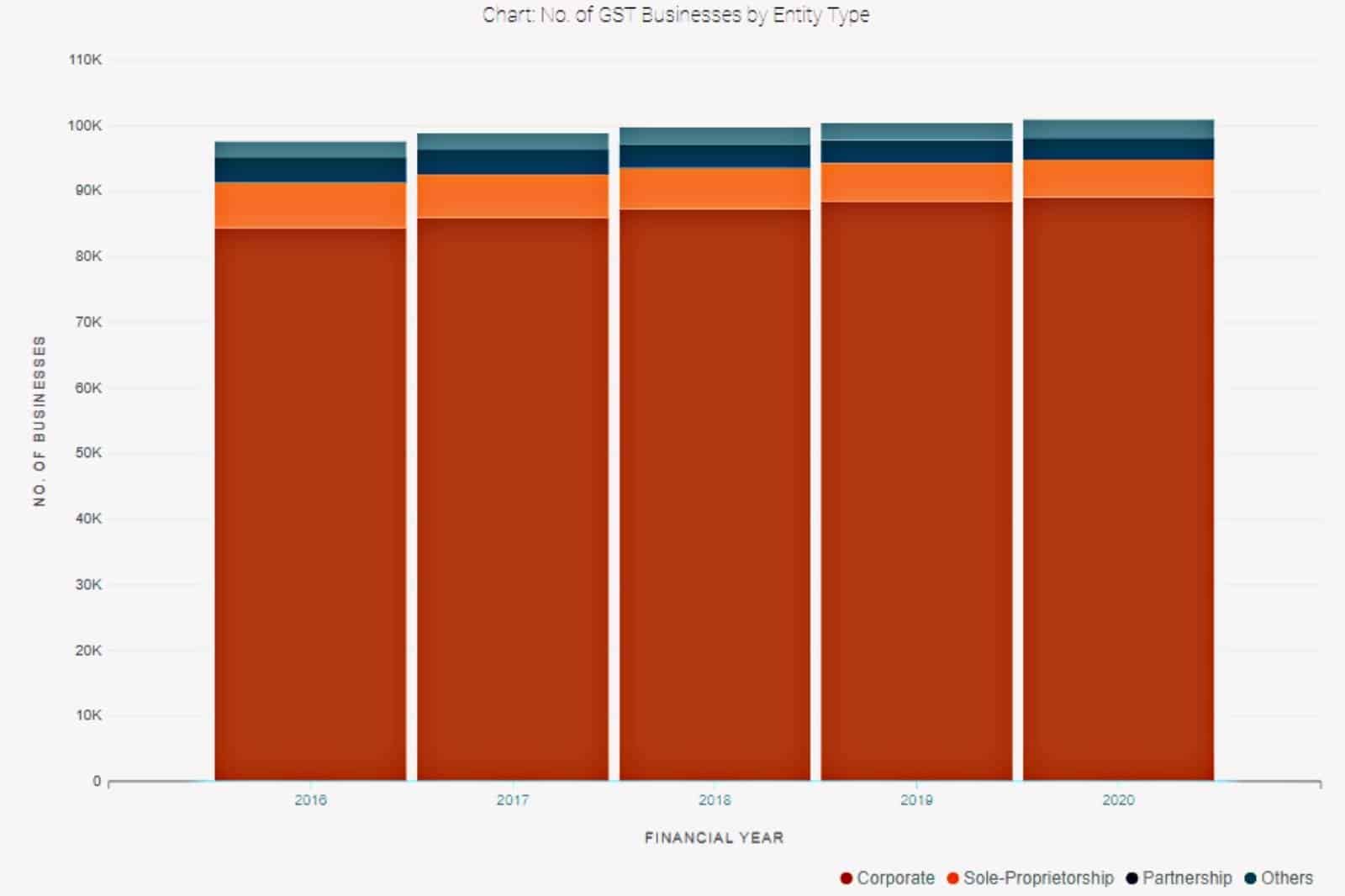

Data.gov.sg has posted a dataset that shows the statistics of the GST contribution made by the Economic Sector of Singapore in the year 2019. The most GST contributions were shown by the wholesale and return sector S$ 3,298,152,000, and the second most contribution for 2019 was from the wholesale and retail industry, which amounted to S$ 2,209,600,000. Thirdly the construction sector contributed Net GST that capped S$ 1,297,055,000. The table below illustrates the data of 2020. To view the datasets of previous years please visit here.

Are You Eligible for An Input Tax Claim?

To satisfy all the required steps to claim an input tax, you have to ensure that the following rules and conditions are being followed.

- You must be a GST-registered business; if not, you are required to register before you make your claim.

- The goods or services that are ordered by you are supplied or have been imported to you.

- All expenses invoices and other documents but be presented if they are local purchases.

- If imported, the claims must be supported by import permits that prove that the imports were ordered on your request

- The received goods or services were used only for business requirements.

- The input taxes are directly connected to the production of taxable supplies (zero-rated supplies or standard-rates supplies) or are out-of-scope supplies that will still be taxable if made in the territories of Singapore.

- All input taxes claimed are obligated by the rules and regulations of the GST Act.

To be eligible for an input tax claim, the company should be:

- Addressed by a tax invoice or a customer accounting tax invoice

- OR addressed by a simplified tax invoice for:

- Any purchase that costs S$1000 or lower and

- Entertainment costs on food and drink only, if there are any expenses other than food and drinks a full tax invoice is still mandatory when supporting your input tax claim.

However, all the submitted documents must be in the corresponding financial year as the date when the input tax must be claimed. To learn more about input tax claiming rules and conditions and the rejected input tax claims, please go to www.iras.gov.sg > GST > GST-registered businesses > Working out your taxes > Can I claim GST (input tax) > Conditions for claiming input tax.

Volunteer Disclosing of Mistakes Made in GST Returns

If The Mistake is Disclosed Within The Grace Period

If The Mistake is Revealed After The Grace Period (While Some Qualifying Conditions are Met)

If the error of the GST returns is announced after one year by the company to the IRAS, the company will be liable to pay 5% of:

- The income tax undercharged or of the amount of cash pay-out / bonus above entitlement gained, for each year the error was late in being amended,

- The GST undercharged, and

- The outstanding Withholding Tax.

If The Company Voluntarily Discloses Late Stamping or Underpayment of Stamp Duty (While The Qualifying Conditions are Met)

Calculating GST

Calculating the GST amount can either be done by an auto-generated GST calculator or done manually. If you are planning to get mathematical, how GST is calculated in different scenarios is explained below.

Finding The GST Mmount from Taxable Turnover

To calculate the GST value from your taxable turnover or GST excluded value of supplies, you can follow the following formula.

GST excluded value X prevailing GST rate = GST amount

For example, if the rate of GST is 7% and the value of supplies excluding GST is S$ 1000, then the GST value is S$ 70

S$ 1000 X 0.07 = S$ 70

Finding The Inclusive GST Amount from GST Excluded Supply Value

To calculate the value of supplies, including GST from the value of supplies (without GST), you can follow the following formula.

GST included value X 1 + prevailing GST rate = GST inclusive amount

For example, if the rate of GST is 7% (0.07) and the value of supplies excluding GST is S$ 1000, then the value of supplies including GST is S$ 1070

S$ 1000 X 1 + 0.07 = GST inclusive amount

S$ 1000 X 1.07 = S$ 1070

Finding The GST Amount from GST Inclusive Supply Value

To calculate the GST value out of the value of supplies (with GST), you can follow the following formula.

(GST included value / 100 + prevailing GST rate number) X prevailing GST rate number = GST amount

For example, if the rate of GST is 7% and the value of supplies included GST is S$ 1070, then the value of GST is S$ 70

(S$ 1070/ 107) X 7 = S$ 70

Finding The GST Exclusive Amount from GST Inclusive Amount

To calculate the GST exclusive amount out of the value of supplies (with GST), you can follow the following formula.

(GST included value*100) / 100 + prevailing GST rate number = GST exclusive amount

For example, if the rate of GST is 7% and the value of supplies included GST is S$ 1070, then the value of GST excluded amount is S$ 1000

(S$ 1070*100) / 107 = GST exclusive amount

S$ 107000 / 107 = S$ 1000

Given below is an example of how input and output tax has been calculated in a cascade diagram that displays the manufacturer to a retailer to an end consumer.

How to file GST Returns to the IRAS

GST Documentation

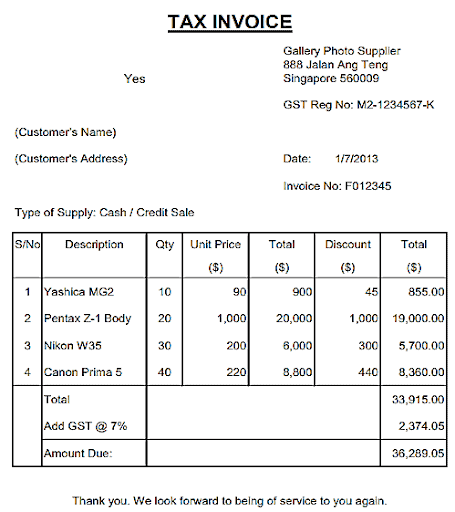

Tax invoice

Tax invoices are documents issued by the GST-registered suppliers to their GST-registered customers on standard-rated purchases so that the clients can present them as supporting documents to claim the input tax from IRAS. This issuance can be issued within a month starting from the date of supplying the purchases to the customers. When it comes to exempt supplies, zero-rated supplies, and/or deemed supplies tax, invoices are not required to be issued. Nevertheless, if you are issuing a tax invoice for the zero-rated supplies, all the necessary information must be mentioned, especially that the GST charged is 0%. When issuing a tax invoice exceeding S$ 1000 (including GST amount), it is crucial that you state the correct, complete details in the right place of your invoices and not misinform or omit any detail. If the tax invoice invalidates you, the client will not be able to use the invoice to support the input tax claim. Also, it is important to note that you can only issue one original tax invoice to your clients. In case the client misplaces the tax invoice or a simplified tax invoice, you can print a copy that must be labelled as “COPY” or “DUPLICATE” and give it to the customer.

What must be mentioned in a tax invoice?

- The words – “tax invoice”- must be highlighted in a prominent place

- A precise identification number (i.e. Invoice Number- 007)

- The date of issuance

- The name, address of your business and the GST registration number

- The name and address of your customer

- A description of the supplies and the supply type

- For each explanation of goods or services provided, the invoice should state: the number of goods or the degree of services, and the taxable turnover

- Cash discount offered- if any

- The total amount excluding GST, the rate of GST and the value of the total

amount of GST chargeable must be indicated as a separate value - The total amount (taxable turnover plus the GST amount chargeable)

- A breakdown of zero-rated, exempt or any other supplies must be written while separately stating the total gross amount payable in each type of supply.

An Example of a Tax Invoice Template

How to Invoice When The Client Uses Foreign Currency?

If the client uses a foreign currency, the GST-registered supplier must convert the monetary values into Singaporean dollars before stating the values in the tax invoice or simplified tax invoice. It is also important to note that the exchange rates that are circulated by local banks or newspapers must be used to exchange the converted monetary values. The exchange rates must be updated at least once every three months to make sure the company is updated on the exchange rate fluctuations where the same source must be continuously used for financial purposes of the business at least for one year at a stretch. The monetary values that must be converted into a tax invoice are:

- Total taxable turnover (amount without GST)

- Total GST amount payable

- Total amount payable by the customer (including GST amount)

How to State Monetary Values in A Tax Invoice?

Value figures of all goods and services said in a tax invoice must be rounded off the nearest whole cent (Or the nearest 5 cents since the 1 cent currency is no longer used) and written with two decimal places. As mentioned above all values must be valued in terms of Singaporean dollars.

Standard-rated supplies can be stated in a tax invoice in two different ways; either way, you will have to choose one method always when issuing your tax invoices. These two methods are:

- Separately calculate the GST value for each line item and add up the GST amount to each line item individually or

- You can calculate the GST amount on the total amount payable at the end of the invoice.

What are The Instances Where Tax Invoices are Not Issued?

- If you are not a GST-registrant

- If your sales follow the Gross Margin Scheme

- If you are a supplier who uses a self-billing arrangement; where your clientele issues the tax invoice

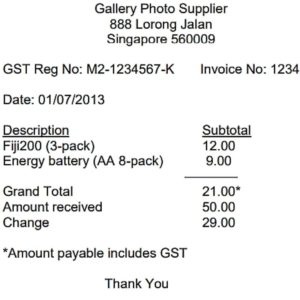

Simplified Tax Invoice

When the total amount of supplies (including the GST amount) does not exceed S$ 1000, the supplier can issue a ‘Simplified Tax Invoice’ to their clients. As the name suggests, it is a summarised version of the ‘Tax Invoice or Full Tax Invoice’. It states less information compared to the tax invoice; a significant change is that the customer’s name is not mentioned in the simplified tax invoice.

What are the details mentioned in a simplified tax invoice?

- Your business’ name, address and your GST registration number

- The identification number (i.e. Invoice Number- 007)

- The date of issuance

- Description of all the goods or services supplied

- The total payable amount of goods and/or services (including GST amount)

- The word- “Price Payable includes GST”- must be clearly stated in the invoice.

An Example of A Simplified Tax Invoice Template

Receipt

When a customer trades with you, and they are not GST-registrants, you will have to issue a receipt instead of a tax invoice to such customers to prove that the payments are settled. A duplicate copy of such receipts must be collected in your company and managed by your curators for audit trials and other financial purposes. Issuing Receipts are not regarded as mandatory by the IRAS, but these documents will help you to have a sound understanding of recording your income in your books or systems. However, this can be done without issuing receipts too. Using an accounting software or a cash register will ensure that the financial transactions of your company are recorded correctly. All income transactions must be well-documented and provided in the audit trails for tax purposes.

What are the details that must be included in a receipt?

- Your business’ name and the GST registration number

- Date of receipt issuance

- Total amount payable (including the sum of GST amount)

- The clear indication of the words: “Price payable includes GST”.

Notes to keep in mind about issuing receipts

What if my customer requests for a receipt when I do not practise issuing receipts?

The customer has the right to ask for a receipt if the supplier does not give a receipt. The suppliers will have to issue a receipt if the customer requests them for a receipt.

What if the purchase value exceeds S$ 1000?

A GST-registrant must issue a tax invoice if any purchase exceeds S$ 1000 as it is an obligation under the GST Act. Even though the GST system waivers off receipts, it does not waiver off tax invoices, so this document must be mindfully maintained.

GST Accounting

GST-registered businesses must maintain the financial records of the company properly. Under the GST Act and the Income Tax Act, failure to record and maintain sufficient financial records is regarded as an offence. If you fail to keep your financial records sufficiently, the GST claims that you can claim as input tax will be disallowed, and the tax authorities will impose obligatory penalties. Such records must be kept for at least the past five years. If you use a computer system, handle the finances of your business, you have to be well-versed in the e-tax guide.

What type of records and documents must be appropriately maintained by a GST-registered business?

- Source documents (vouchers, receipts, invoices) that provide evidence to all the transactions that take place in your business.

- The business accounting information- manual or electronic accounting records and schedules (capital, liabilities, assets, losses, gains)

- Bank Statements

- And all other documents that prove the transactions of a business.

UEN, ACRA and GTS Numbers

What is A UEN Number?

A unique Entity Number (abbreviated as UEN) is a standard 10-digit code of identifying entities by government agencies. You can use your UEN number for tax filing or applying for permits to import or export goods. You can also use your UEN code in your Letterheads, ems, order forms, brochures, receipts, faxes, leaflets or more. In legal terms, limited companies must share their UEN code on any other printed or online publication that was shared for business purposes.

The efficiency behind the UEN number is that you can use the same number assigned for you to interact with different government bodies conveniently. With one UEN code, you can:

- Update your entity information in Accounting and Corporate Regulatory Authority (ACRA)

- Apply for trade permits

- Make CPF payments with Central Provident Fund Board (an additional sub-code will be provided by them)

- File tax returns in the IRAS

Who Issues and Who Gets UEN?

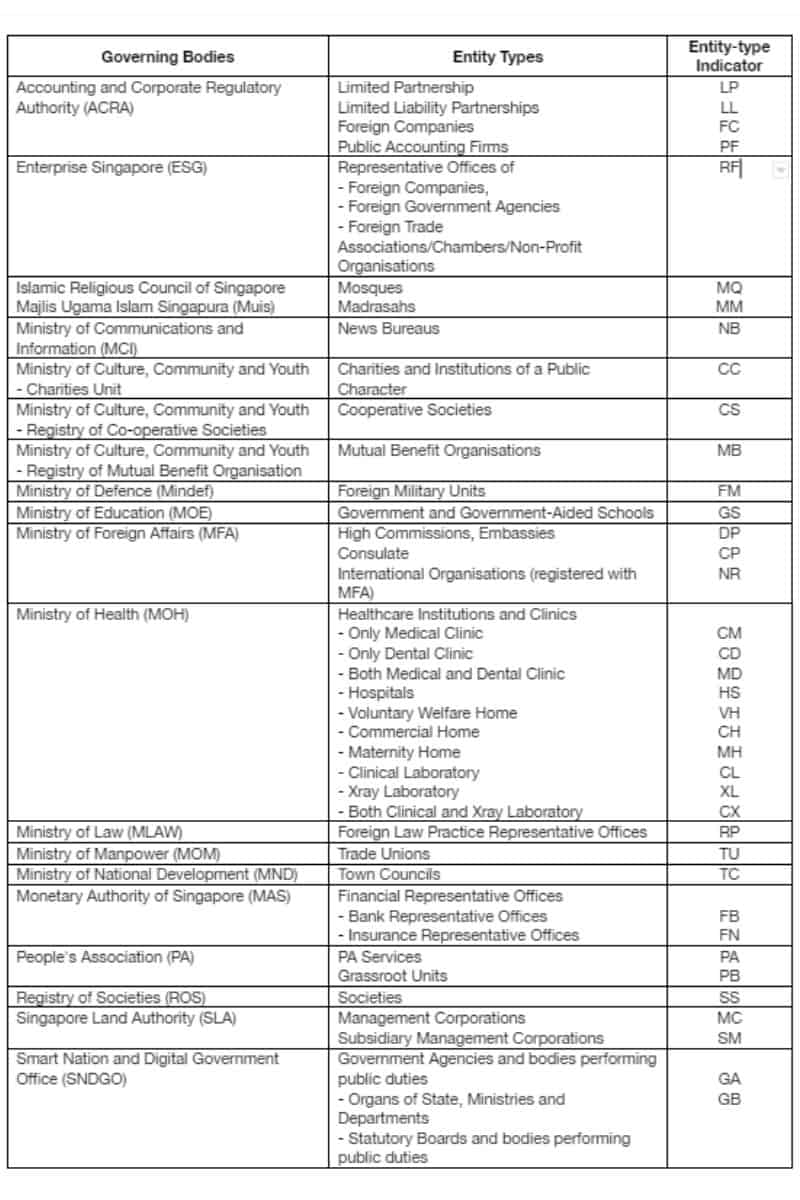

Different governing bodies are entitled to issue UEN to different types of entities. The following chart was posted on a Singapore Government Agency Website; it displays which governing body is responsible for giving a UEN number to which entity. Click here to learn more about the UEN number.

As mentioned in the table above, UEN numbers are received by different sorts of entities who have multiple interactions with government bodies.

UEN is not issued for:

- Individuals

- Entities that have single interactions with government bodies

- Sub-entities of a primary entity

What is An ACRA Number?

ACRA or the Accounting and Corporate Regulatory Authority is a statutory board formed on the 1st of April 2004 that collaboratively monitors corporate compliances with directing public accountants performing statutory audit and disclosure requirements. This board is responsible for:

- Changing or updating any sort of register details of a company

- Filing annual accounts

- Filing copies of a resolution

- Issuing shares or executing changes to the Shareholding Structure

- Terminating a company

ACRA is also the governing body that provides ACRA numbers (or UEN numbers) for local companies or businesses. Therefore, entities that are already enrolled in ACRA are assigned with an ACRA registration number and will use it as their UEN rather than requesting a new UEN. An ACRA number given to local companies is 10 digits, while ACRA numbers given to businesses are 9 digits.

What is A GST Number?

A GST number is an identification code used by the GST system to register businesses in the GST system. If a company is already enrolled with an ACRA number, IRAS will register the business using it. Still, if not, a separate GST number will be given for the company after the completion and approval of the necessary GST applications.

The significances of a GST number are:

- It will be printed on invoices, receipts and credit notes

- Asked by IRAS to provide you with e-services such as:

- filing for GST returns,

- cancellation of GST Registration,

- requesting for waivers for penalties or extension of the tax filing deadline,

- settlement of taxes,

- retrieving past GST returns

- updating contact details in the GST system

- to carry out activities using the myTax Portal